NERFED. TL;DR version

- therichpoordad

- Jul 1, 2025

- 2 min read

The nerf season has become quite absurd in recent days. What exactly occurred? Here's a brief overview of the main nerfs without delving too deeply into the specifics:

Credit Card Nerfs:

UOB Lady's Solitaire

Pre-nerf:

Max bonus miles given up to S$2k on 2 selected categories

Post-nerf:

Max bonus miles given up to S$1.5k instead of S$2k spend

Each of the 2 categories selected can only receive max bonus miles up to S$750 each

UOB Visa Signature

Pre-nerf:

Bonus miles given with min S$1k up to S$2k on either foreign currency spend or petrol & contactless category

Post-nerf:

Bonus miles given for Foreign currency spend now min S$1k with max S$1.2k

Bonus miles given for Petrol & Contactless spend now min S$1k with max S$1.2k

DBS Woman's World Card

Pre-nerf:

Max bonus miles given up to S$1.5k on online transaction

Post-nerf:

Max bonus miles given up to S$1k on online transaction

Maybank Platinum Visa

Pre-nerf:

Get 3.33% rebate for S$2k spend monthly (includes CardUp)

Post-nerf:

Get 3.33% rebate for S$2k spend monthly BUT Specific transactions (like CardUp) are limited to 30% (i.e. S$600)

Remaining S$1400 spend need to be on "General" categories

Chocolate Finance Credit Card

Pre-nerf:

2 Max Miles per dollar up to S$2k spend (including Utilities & Insurance)

Post-nerf:

1 Max Miles per dollar up to S$1k spend

Utilities & Insurance spend capped at S$100 monthly

Amex Pay

Pre-nerf:

Use Amex Pay at hawkers to get Membership Rewards Points

Post-nerf:

Amex Pay will be discontinued

HSBC Revolution Visa

Pre-BUFF:

Max bonus miles given up to S$1k on online transaction

Post-BUFF:

Max bonus miles given up to S$1.5k on online transaction + travel + contactless

Between 1 July to 31 October 2025

Savings Accounts NERFS:

Cashback:

HSBC EGA - drops cashback on GIRO payments from 1% to 0.5% (BIG OUCH)

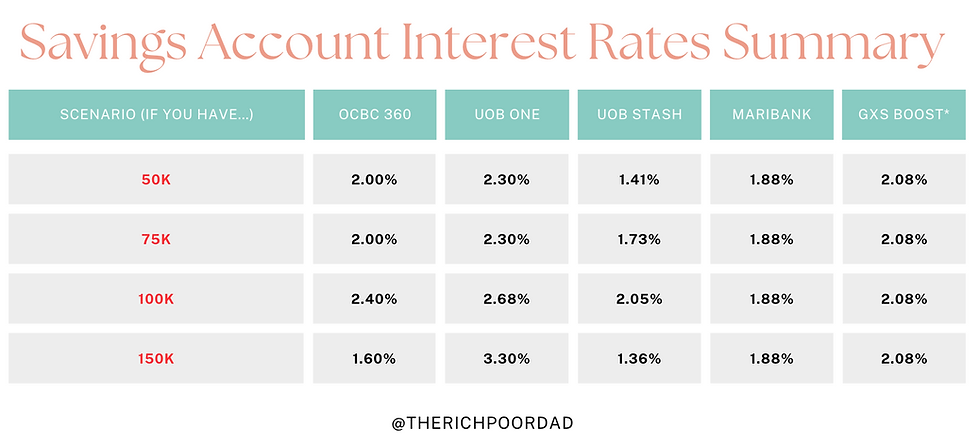

"Realistic" Interest rate drops:

OCBC 360 - from 3.25% to 2.40% if you have 100k

UOB One - from 4.00% to 3.30% if you have 100k

UOB Stash - 3.00% to 2.05% if you have 100k

Comments